Transaction Advisory Services Things To Know Before You Buy

Wiki Article

6 Easy Facts About Transaction Advisory Services Described

Table of ContentsLittle Known Questions About Transaction Advisory Services.Getting The Transaction Advisory Services To WorkThe Transaction Advisory Services IdeasWhat Does Transaction Advisory Services Do?The Main Principles Of Transaction Advisory Services The Ultimate Guide To Transaction Advisory ServicesSome Known Questions About Transaction Advisory Services.

In our occupation, the term "advisory solutions" is made use of regularly, however there is little consensus concerning what it really suggests. When we ask multi-service companies which consultatory services they offer, the spectrum of feedbacks is unbelievably wide and usually overlaps with standard compliance services. Discover much more Compliance solutions are needed, and there is very little differentiation in the deliverable in between experts.The truth that a lot of companies include the specific same conformity description on customer invoices reinforces that there is absolutely nothing special concerning the conformity report. On the other hand, the advice, competence, planning and method that went right into the procedure prior to the record was produced are really separated.

Compliance reporting is a byproduct of well-defined consultatory solutions. Deadline driven Historic customer documents Information entry and format Validated computations Done by the professional Uniform records Year-round activity Genuine time information Ready for evaluation Automated reporting Joint strategies Individualized insights Compliance solutions in accountancy simply implies guaranteeing the company's monetary documents, reports, and filings conform with the applicable guidelines and standards for the type of service.

What Does Transaction Advisory Services Mean?

Maybe broadening your client base, new line of product, or enhanced sales quantities, each with intricate operational and financial demands. On one side, growth is an excellent signal, and on the other, it requires planning if it has actually to be maintained. This can be an arrangement to structure and have systems in area to ensure that even more tasks can be allowed without stressing resources.Practices introduced during the duration are at top performance, protecting against typical problems such as cash shortages or over-extended sources from halting expansion. A steady cash circulation exists at the heart of excellent wellness for any kind of firm, but it can obtain extremely difficult to manage when the markets get unstable. They might aid to reorganize debt, renegotiate agreements, or streamline procedures so as to cut down on prices and ultimately have better monetary health.

For companies that companion with an audit company in Sydneyhaving accessibility to strong financial proficiency indicates taking an all natural strategy to economic administration. With its house consultants, the firms can minimize financial dangers and start pursuing developing healthy cash money circulation to sustain sustainable development. Strategic planning is a needs to for any organization that intends to succeed over the lengthy term.

10 Easy Facts About Transaction Advisory Services Described

Regulatory compliance is very important to maintain legal standing and protect the online reputation of a company. Regulatory requirements in extremely controlled or vibrant markets can be extremely costly and taxing if not correctly managed. Whether it remain in healthcare, finances, or any kind of manufacturing company, it comes to be very essential to maintain upgraded with all the regulatory needs.They thus help establishments establish their own compliance programs and create effective record-keeping methods to maintain them upgraded with transforming regulation that may impact their operation. Prevention of interruptions in procedure and defense of track record is as a result possible with aggressive compliance. Organisations must prepare for dangers that can affect their everyday procedures and the lasting success of business in unclear company atmospheres.

Experienced financial leadership is required to lead long-term technique and operational performance. Offers comprehensive economic management, from tactical planning to run the risk of analysis.

The Best Guide To Transaction Advisory Services

Our years of experience handling deals of all kinds imply that we comprehend the financial and emotional sides of the procedure and can be one action ahead of you, preparing you for what to expect next and keeping an eye out for challenges along the way. Our firm prides itself on promoting lasting connections with our customers.Create sophisticated financial structures that assist in establishing the real market price of a company. Offer consultatory work in connection to company valuation to aid in negotiating and pricing frameworks. Discuss one of the most appropriate form of the bargain and the type of factor to consider to utilize (cash, supply, make out, and others).

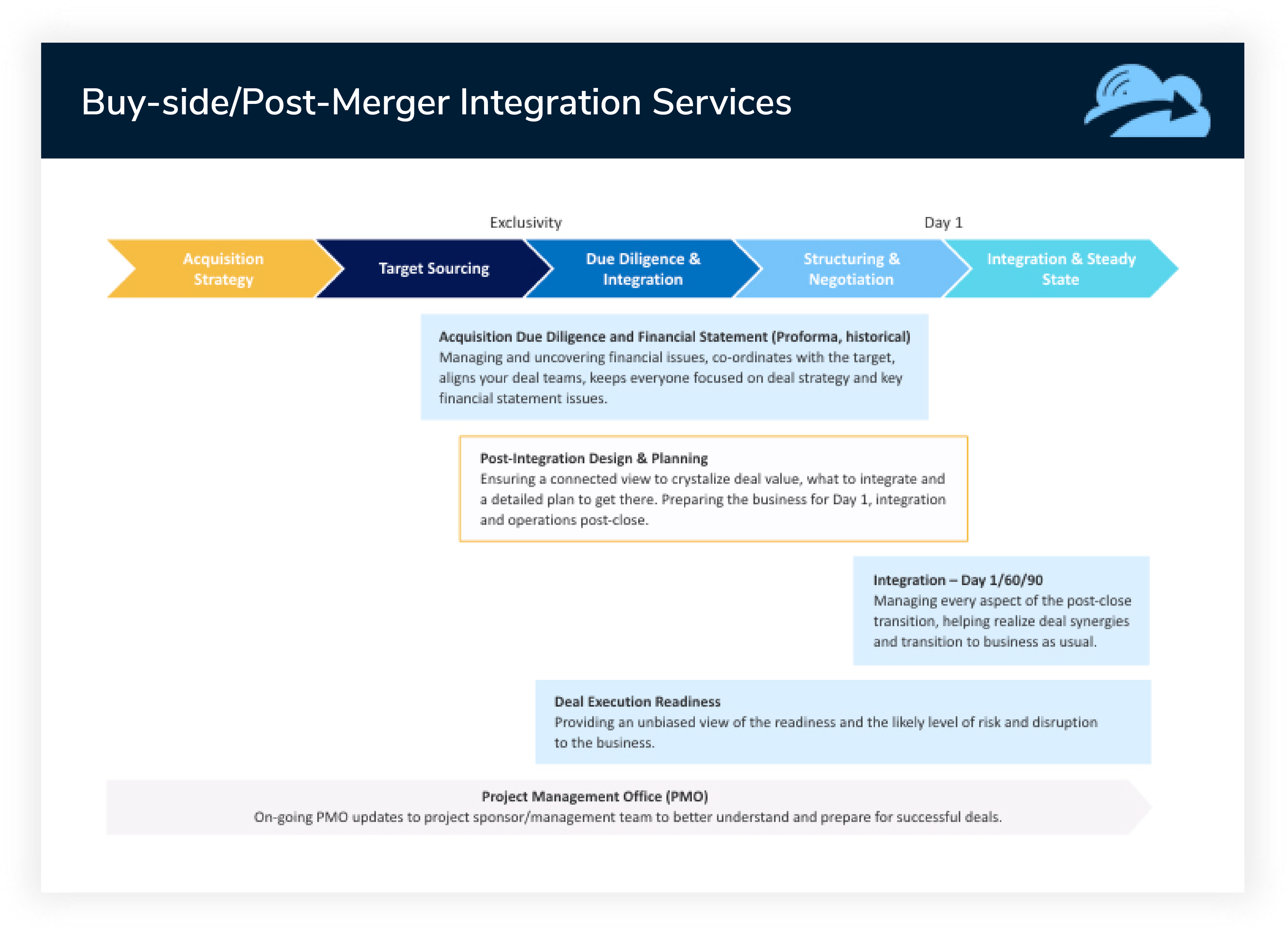

Develop activity prepare for risk and direct exposure that have been recognized. Transaction Advisory Services. Carry out assimilation planning to determine the process, system, and business modifications that might be needed after the bargain. Make numerical price quotes of integration prices and benefits to examine the financial rationale of combination. Set guidelines for incorporating divisions, modern technologies, and business processes.

Top Guidelines Of Transaction Advisory Services

Reassessing the company's income recognition policies for potential overaggressive nature. Taking a look at certain phenomenal and non-exceptional cyclists that misshape revenue. Identifying the out-of-pattern purchases that are not related to normal operations of the business. Fine-tuning EBITDA to create an extra secure earnings growth pattern. By evaluating these elements, advisors can try this out approximate maintainable revenues ability of business as contrasted to reported revenue declaration.

Certain activities, timeframes for product and solution assimilation, selling strategies. Address combination of address systems, location approach, job results. Estimate possible price re uction with the time framework for each action.

Our years of experience managing purchases of all kinds mean that we comprehend the monetary and psychological sides of the procedure and can be one action ahead of you, preparing you of what to anticipate following and keeping an eye out for challenges along the method. Our firm prides itself on cultivating lasting connections with our clients.

How Transaction Advisory Services can Save You Time, Stress, and Money.

Create innovative financial frameworks that help in figuring out the actual market value of a firm. Offer advisory job in relation to company valuation to help in negotiating and rates structures. Explain one of the most appropriate type of the deal and the sort of consideration to employ (money, stock, gain out, and others).

Carry out integration preparation to figure out the process, system, and organizational changes that may be required after the deal. Set guidelines for integrating departments, technologies, and business processes.

Finding the out-of-pattern transactions that are not related to routine operations of the service. By examining these aspects, advisors can approximate maintainable profits ability of the company as compared to reported earnings declaration.

Some Known Factual Statements About Transaction Advisory Services

Recognize potential reductions by minimizing DPO, DIO, and DSO. Analyze the potential client base, market verticals, and sales cycle. Consider Recommended Reading the possibilities for both cross-selling and up-selling. The operational due diligence supplies vital insights into the performance of the company to be gotten worrying danger evaluation and value creation. Identify short-term modifications to finances, banks, and systems.Particular actions, timeframes for services and product assimilation, marketing methods. Define targets for cross-selling tasks, brand modification. Survey a plan for integrating money, HUMAN RESOURCES, IT, and various other divisions. Address combination of address systems, place method, work results. Figure out chances for lowering headcount, procurement prices. Estimate feasible expense decrease with the time frame for his response each and every action.

Report this wiki page